👑 Airdrop Royalty: $RESOLV Awaits!

💰 Want to build your crypto empire? Start with the free $RESOLV airdrop!

🏆 A golden chance to grow your wallet — no cost, no catch.

📅 You’ve got 30 days after registering. Don't wait too long!

🌟 Be among the first movers and enjoy the biggest rewards.

🚀 This is your gateway to potential wealth in Web3.

Introduction: The Critical Need for Financial Security

In today’s digital age, knowing how to secure funds safely isn’t just wise—it’s essential. With cybercrime costing the global economy over $6 trillion annually, protecting your money requires proactive strategies. This guide delivers actionable best practices to shield your finances from fraud, scams, and unauthorized access. Whether you’re safeguarding personal savings or business capital, these proven methods form your first line of defense in an increasingly risky financial landscape.

Why Securing Funds Demands Immediate Attention

Financial security breaches can devastate individuals and businesses alike. Identity theft affects millions yearly, while phishing scams drain billions from bank accounts. Beyond digital threats, physical vulnerabilities like document theft or social engineering attacks create additional risks. Implementing robust fund protection measures prevents catastrophic losses, preserves creditworthiness, and delivers peace of mind. Remember: Security isn’t a one-time task but an ongoing commitment.

8 Essential Best Practices to Secure Funds Safely

1. Fortify Authentication Protocols

Use complex, unique passwords (12+ characters with symbols/numbers) for all financial accounts. Enable biometric authentication (fingerprint/facial recognition) where available. Never reuse passwords across platforms.

2. Mandate Two-Factor Authentication (2FA)

Activate 2FA on every financial account. Prefer authenticator apps over SMS verification. This adds a critical second layer of security beyond passwords.

3. Implement Transaction Monitoring

Set up real-time alerts for all account activity. Review statements weekly for unauthorized transactions. Use credit monitoring services to detect identity theft early.

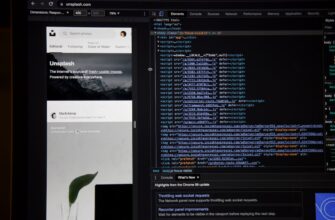

4. Secure Digital Communication Channels

Only access financial accounts through encrypted connections (look for HTTPS://). Avoid public Wi-Fi for transactions. Use VPNs when accessing accounts remotely.

5. Maintain Software Vigilance

Install updates immediately for banking apps, operating systems, and antivirus software. Outdated software contains vulnerabilities hackers exploit.

6. Verify Before Trusting

Confirm payment requests via secondary channels (phone call to known number). Never share verification codes. Banks never ask for full passwords via email.

7. Protect Physical Assets

Store checks and financial documents in locked safes. Shred sensitive paperwork before disposal. Secure devices with auto-lock features.

8. Diversify Storage Solutions

Spread funds across multiple insured accounts. Consider FDIC/NCUA-insured institutions. For large sums, explore treasury bonds or segregated custodial accounts.

Advanced Protection Strategies

Beyond basic measures, enhance security with these approaches: Use dedicated devices solely for banking transactions. Establish multi-signature requirements for business accounts. Explore cold storage options for cryptocurrency holdings. Regularly audit account permissions and remove unused access rights. Consult certified financial advisors to create layered protection plans tailored to your asset profile.

FAQs: Secure Funds Safely Best Practices

Q: How often should I change my banking passwords?

A: Change passwords every 90 days, or immediately after any security alert. Use a password manager to maintain unique credentials.

Q: Are digital wallets safer than physical cards?

A: Yes, when properly secured. Digital wallets use tokenization and biometrics, reducing exposure of actual card numbers during transactions.

Q: What should I do if I suspect fraud?

A: Immediately contact your financial institution, freeze affected accounts, file an FTC report at IdentityTheft.gov, and monitor credit reports.

Q: How can I verify a financial app’s security?

A: Check for bank-level encryption (AES-256), read independent security audits, verify developer credentials, and review app permissions critically.

Q: Is SMS verification secure for banking?

A: It’s the least secure 2FA method. SIM swapping attacks can compromise it. Use authenticator apps or hardware tokens instead.

Conclusion: Building Unbreakable Financial Habits

Securing funds safely requires combining technology, vigilance, and disciplined habits. By implementing these best practices consistently, you create multiple defensive layers that deter most threats. Remember that financial security evolves—stay informed about emerging scams and update your protocols accordingly. Your proactive measures today prevent devastating losses tomorrow, ensuring your hard-earned money remains protected through every transaction and investment.