👑 Airdrop Royalty: $RESOLV Awaits!

💰 Want to build your crypto empire? Start with the free $RESOLV airdrop!

🏆 A golden chance to grow your wallet — no cost, no catch.

📅 You’ve got 30 days after registering. Don't wait too long!

🌟 Be among the first movers and enjoy the biggest rewards.

🚀 This is your gateway to potential wealth in Web3.

- Introduction: The Critical Need for Financial Cybersecurity

- Understanding the Hacker’s Playbook: Common Attack Vectors

- Fortifying Your Digital Wallets: Core Protection Strategies

- Mastering Password Security & Two-Factor Authentication

- Safe Browsing & Email Protocols

- Software & Device Hardening Techniques

- Phishing Scam Recognition Guide

- Hardware Wallets: The Gold Standard for Crypto Protection

- Incident Response: When Suspicion Arises

- FAQ: Guard Funds from Hackers Tutorial

- Conclusion: Vigilance Is Your Best Firewall

Introduction: The Critical Need for Financial Cybersecurity

With digital theft costing victims over $6.9 billion in 2021 alone (FBI IC3 Report), learning how to guard funds from hackers is no longer optional—it’s essential survival skill. This comprehensive tutorial delivers actionable strategies to shield your crypto, bank accounts, and digital assets from evolving cyber threats. Whether you’re a crypto holder, online investor, or frequent digital payer, these evidence-based techniques form your first line of defense.

Understanding the Hacker’s Playbook: Common Attack Vectors

Hackers deploy sophisticated methods to compromise financial security. Key threats include:

- Phishing scams: Fake emails/texts mimicking legitimate institutions

- Malware: Keyloggers and ransomware infecting devices

- SIM swapping: Hijacking phone numbers to bypass 2FA

- Exchange hacks: Breaches targeting cryptocurrency platforms

- Public Wi-Fi snooping: Intercepting data on unsecured networks

Fortifying Your Digital Wallets: Core Protection Strategies

Implement these non-negotiable security measures across all financial accounts:

- Enable biometric authentication (fingerprint/face ID) where available

- Use unique 16+ character passwords generated by managers like Bitwarden or 1Password

- Activate withdrawal whitelisting to restrict transaction addresses

- Set low daily transaction limits for all payment accounts

- Regularly review connected apps and revoke unused permissions

Mastering Password Security & Two-Factor Authentication

Passwords alone won’t guard funds from hackers. Implement layered verification:

- Password hygiene: Never reuse passwords. Change them quarterly.

- 2FA essentials: Avoid SMS verification—use authenticator apps (Google Authenticator, Authy) or physical security keys (YubiKey)

- Backup codes: Store printed copies in secure locations—never digitally

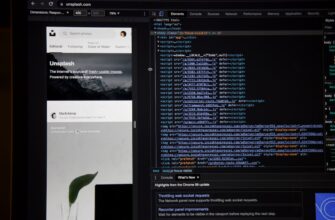

Safe Browsing & Email Protocols

Most breaches start with deceptive communications. Adopt these habits:

- Verify sender email addresses by checking full headers

- Hover over links to preview actual URLs before clicking

- Install browser extensions like uBlock Origin to block malicious ads

- Never access financial accounts on public computers

- Use VPNs with AES-256 encryption when on shared networks

Software & Device Hardening Techniques

Outdated systems are hacker gateways. Maintain ironclad hygiene:

- Enable automatic OS and app updates across all devices

- Install reputable antivirus software with real-time scanning

- Wipe old devices with factory resets before disposal

- Disable Bluetooth/Wi-Fi when not in use to prevent exploits

- Encrypt hard drives using BitLocker (Windows) or FileVault (Mac)

Phishing Scam Recognition Guide

Spot red flags with this checklist:

- Urgent threats demanding immediate action

- Generic greetings like “Dear User” instead of your name

- Suspicious attachments (e.g., .exe, .scr files)

- Mismatched URLs in hyperlinks

- Requests for passwords or seed phrases

Golden rule: Institutions never ask for credentials via email.

Hardware Wallets: The Gold Standard for Crypto Protection

For cryptocurrency holders, offline storage is paramount:

- How they work: Private keys never leave the encrypted USB device

- Top options: Ledger Nano X, Trezor Model T, Coldcard

- Setup protocol: Initialize in private, generate new seed phrases offline

- Backup strategy: Store metal seed plates in multiple secure locations

Hardware wallets reduce attack surfaces by 95% compared to hot wallets (CipherTrace Report).

Incident Response: When Suspicion Arises

If you detect unusual activity:

- Immediately freeze accounts through your financial institution

- Disconnect compromised devices from internet

- Scan systems with Malwarebytes or HitmanPro

- Change ALL passwords from a clean device

- Report to authorities: FTC (US), Action Fraud (UK), or local cybercrime units

FAQ: Guard Funds from Hackers Tutorial

Q: Can antivirus software alone protect my funds?

A: No. Antivirus is just one layer—combine it with 2FA, hardware wallets, and security hygiene for comprehensive protection.

Q: How often should I check for unauthorized transactions?

A: Daily monitoring is ideal. Set transaction alerts for real-time notifications on all accounts.

Q: Are password managers vulnerable to hacking?

A> Reputable managers use zero-knowledge encryption—your master password never leaves your device. They’re significantly safer than password reuse.

Q: What’s the most overlooked security step?

A> Regularly updating router firmware. Outdated routers are common entry points for network breaches.

Q: Should I use multiple email accounts for finances?

A> Absolutely. Dedicate one email exclusively for banking/crypto with maximum security settings, separate from everyday use.

Conclusion: Vigilance Is Your Best Firewall

Guarding funds from hackers requires continuous adaptation to new threats. By implementing this tutorial’s layered approach—combining hardware security, authentication protocols, and behavioral awareness—you create a formidable defense matrix. Remember: In cybersecurity, convenience is the enemy of safety. Prioritize protection over shortcuts, and transform yourself from a target into a fortress.